The way India shops has transformed. The ecommerce vs quick commerce debate highlights how online shopping has evolved in two distinct directions. E-commerce continues to scale with nationwide reach, optimised supply chains, and affordable delivery, while quick commerce has redefined convenience with deliveries in minutes.

Today, large-scale e-commerce is led by platforms such as Amazon, Flipkart, Meesho, Myntra, and Nykaa, all built on centralised warehouses, long-haul transportation, and cost-efficient last-mile networks that enable pan-India reach.

Quick commerce, meanwhile, is dominated by Blinkit, Zepto, Swiggy Instamart, Dunzo, and BB Now (BigBasket’s quick-delivery arm). These players operate on hyperlocal dark-store models, prioritising speed over scale and serving limited pin codes with ultra-fast fulfilment.

This blog breaks down both models through a logistics lens, helping you understand what works, what scales, and where your products fit best.

Understanding Ecommerce Logistics

Ecommerce logistics is built for reach, scalability, and cost efficiency. It focuses on moving inventory across larger geographies with consolidated shipping and multi-courier networks. This model thrives on structured operations, predictable inventory, and optimised last-mile processes.

- Here’s what forms the foundation of ecommerce logistics:

- Centralised or regional warehousing

- Multi-courier delivery networks

- Standard delivery timelines (2–7 days)

- Emphasis on lower cost per delivery

- Higher RTO risks, especially for COD orders

Understanding Quick Commerce Logistics

Quick commerce runs on an entirely different engine, built for speed, ultra-local availability, and real-time rider deployment. It prioritises immediate fulfillment using dense dark stores, limited SKUs, and hyperlocal last-mile fleets.

Below are the core components of quick commerce logistics:

- Dark stores positioned within 1–3 km radius

- Micro-inventory for fast-moving essential

- Delivery in 10–60 minutes

- High operational cost and manpower dependency

- Nearly zero RTOs due to instant delivery

Ecommerce vs Quick Commerce: How They Differ in Logistics?

Ecommerce and quick commerce operate on completely different logistical foundations. While ecommerce optimises reach and cost, quick commerce optimises speed and immediacy. These differences impact cost, scalability, operational load, and customer expectations.

Here’s a quick logistics comparison to understand the gap clearly:

Logistics Comparison: Ecommerce vs Quick Commerce

| Logistics Aspect | Ecommerce | Quick Commerce |

| Delivery Speed | 2–7 days | 10–60 minutes |

| Inventory Model | Central/regional warehouses | Dark stores, micro-warehouses |

| Product Assortment | Large catalogue | Limited essentials |

| Order Density | Spread across geography | Cluster-based high density |

| Delivery Cost | Low due to consolidation | High due to speed requirements |

| Demand Pattern | Planned purchases | Instant, impulse purchases |

| Courier Dependency | Multi-3PL partners | In-house/hyperlocal fleets |

| Returns (RTO) | High, especially COD | Very low |

| Operational Complexity | Moderate to high | Extremely high |

| Scalability | High across India | Limited to dense urban clusters |

Delivery Speed & Last-Mile Expectations

The biggest differentiator between ecommerce and quick commerce is the last mile. Ecommerce deliveries take time because orders move through multiple transit hubs. Quick commerce compresses the supply chain into a single hop, store to customer.

Below are the critical last-mile differences:

- Ecommerce: hub → sorting center → delivery associate → customer

- Q-commerce: dark store → rider → customer

- Ecommerce: high delivery radius

- Q-commerce: extremely small delivery radius

- Ecommerce: dependent on courier partners

- Q-commerce: dependent on in-house riders

Inventory & Warehousing Structure

Inventory strategy defines how fast an order can be delivered. Ecommerce prioritises storing a large assortment at fewer nodes, while Q-commerce needs hundreds of micro-centres.

Here’s how both models differ in inventory flow:

- Ecommerce:

- Large SKU range

- Bulk procuremen

- High reliance on forecasting

- Lower operational cost per unit

- Quick Commerce:

- Very limited SKU range

- High-frequency replenishment

- Real-time stock sync needed

- Higher overall operations cost

Cost Structure & Delivery Economics

Speed increases cost and this is where both models diverge sharply. Ecommerce keeps shipping economical; Q-commerce spends heavily on instant delivery, rider availability, and real-time inventory accuracy.

Below are cost-related gaps you should consider:

- Ecommerce delivers at ₹35–₹90 per order depending on courier

- Quick commerce delivers at ₹60–₹150 per order internally

- Ecommerce scales well with consolidated shipment

- Quick commerce needs constant manpower availability

- Ecommerce enjoys pan-India reach

- Quick commerce is viable only in dense metros

Also read: Top 5 Same Day Intracity Delivery in India

RTO, NDR & Address Accuracy Challenges: Ecommerce vs Quick commerce

RTO is one of the biggest challenges of ecommerce especially COD. Quick commerce avoids this almost entirely because orders are prepaid or instantly delivered, leaving no room for cancellations or fake addresses.

Below are the logistics pain points brands must evaluate:

- Ecommerce:

- High RTO risk

- Address inaccuracy

- NDR follow-ups

- Customer unavailability

- Multiple delivery attempts

- Quick Commerce:

- Almost zero RTO

- Instant fulfillment solves address issues

- No NDR cycle

- Very low customer disputes

Scalability & Operational Complexity

Ecommerce scales across India with courier partnerships and warehouse expansion. Quick commerce cannot scale the same way because it depends on population density, high order volumes, fleet availability, and dark-store infrastructure.

Below is how scalability differs across both models:

- Ecommerce:

- High scalability

- Works for tier 1, 2, 3 cities

- Courier partnerships expand reach

- Tech automations reduce ops load

- Quick Commerce:

- Hyperlocal only

- Limited to metro clusters

- Needs heavy infrastructure

- Higher operational overhead

Which Model Should Your Brand Choose?

Neither model is universally better, the right choice depends on your product category, margins, demand frequency, and delivery expectations. Most brands today follow a hybrid approach:

E-commerce for scale + Q-commerce for instant essential demand.

Here are the filters brands should use before choosing a model:

- Does your product require immediacy?

- Do your margins support instant delivery?

- Is your target audience clustered in metro areas?

- Do you have fast-moving SKUs?

- Do you need nationwide reach?

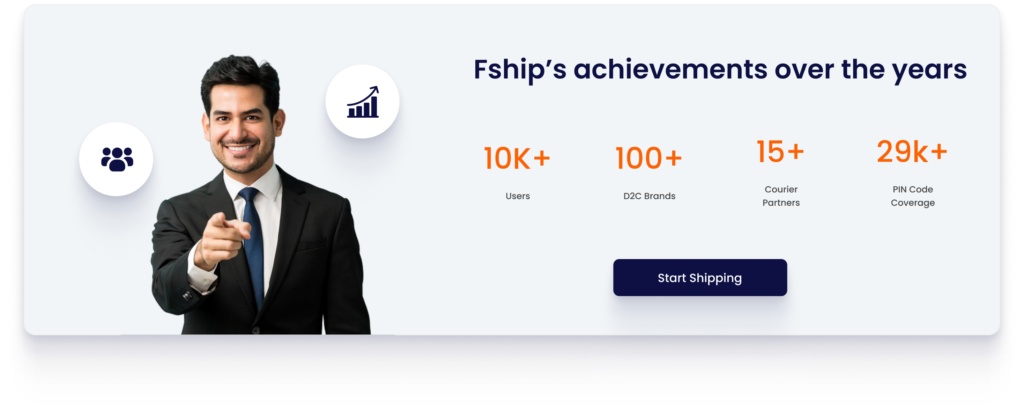

How Fship Supports Ecommerce Brands With Scalable Logistics?

While Q-commerce handles speed, ecommerce needs strong logistics tech to reduce delays, improve accuracy, and manage RTO. Fship enables brands to ship smarter through:

- AI-based courier allocation for faster delivery

- 27k+ pin code reach across India

- Real-time branded tracking

- NDR & RTO automation

- Address accuracy tools & custom validation rules

- WhatsApp & SMS delivery updates

- Deep analytics for performance monitoring

Fship helps ecommerce brands build a reliable, scalable, and cost-efficient shipping ecosystem, so you can deliver with consistency, not chaos.

Ecommerce vs Quick Commerce : FAQs

✅ Brands should evaluate ecommerce vs quick commerce based on product type, order value, margins, and customer expectations. Many brands adopt a hybrid approach, using ecommerce for scale and quick commerce for speed in high-demand locations.

✅ The key difference in ecommerce vs quick commerce lies in delivery speed and logistics structure. Ecommerce focuses on nationwide reach using centralised warehouses and cost-efficient delivery timelines, while quick commerce operates through hyperlocal dark stores to enable deliveries within minutes.

✅ Yes, many brands adopt an omnichannel strategy by combining ecommerce and quick commerce. Ecommerce is used for planned purchases and expansion into new markets, while quick commerce supports urgent orders and improves customer experience in high-density urban areas.